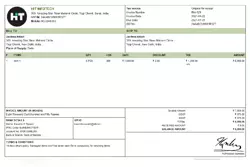

Free Tax Billing Tool for Local Traders

Lifetime FREE GST Billing Software, Manage your complete business with Khata Billing. Best software for billing, inventory & accounting. Most simple, secure & easy Software. Start Now!

Managing IGST filing is one of the most critical responsibilities for Indian enterprises.

The ever-changing GST rules often make invoicing feel confusing, especially for small organizations.

This solution offers a complimentary and easy-to-use tax accounting tool designed especially for local entrepreneurs.

It helps you create GST-compliant receipts, monitor ledgers, and streamline your daily business operations.

Unlike overloaded accounting systems, KhataBilling is built to support the practical needs of local shop owners.

From service-based businesses to traders, it provides a centralized system to control billing and customer-wise accounts.

Key Features of Our Software

- Tax Invoice Creation with IGST Support

- Customer-wise Khata Tracking

- Purchase Invoices & Returns

- Stock Tracking with Item-wise Alerts

- Receipt Tracking & Due Reports

- Loss & GST Reports

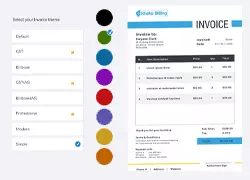

- Custom Bill Formats

- Staff Access Control

- Online Access from Anywhere

Free Tax Bill Maker

With KhataBilling, you can quickly download professional bills without GST knowledge.

Simply add your customer details, products, and tax rates — your invoice is ready in seconds.

Inventory & Billing System for Small Businesses

Managing inventory separately from billing often leads to mistakes.

This system integrates both into a single platform, giving you live visibility of items and ledger data.

Whether you run a service business or manage growing clients, this GST billing software helps you reduce time, minimize errors, and grow your company with confidence.

Finding Affordable Payment Software for Local Business in Bharat

Navigating the digital landscape as a small business in India can be challenging, especially when it comes to managing finances. Luckily, numerous inexpensive payment solutions are now available that cater specifically to the needs of tiny companies. These applications can streamline your invoice processes, reduce errors, and improve cash movement. Quite a few options provide user-friendly interfaces, automated notifications, and seamless connection with widespread financial systems. Reviewing and evaluating various billing software is crucial to locating the best solution for your specific company requirements and funds. Look at factors like future expansion, user support, and safety features before making a selection.

Inventory and Billing Solutions

Are you struggling difficulties managing your stock and billing? Quite a few businesses are finding that juggling individual spreadsheets and software is a recipe for inaccuracies and lost time. Thankfully, a comprehensive solution exists: all-in-one inventory and billing applications. This type of system combines your processes, allowing you to manage inventory in real-time, generate correct invoices, and optimize your complete financial management. Rather than manual input, automation reduces overhead and frees up your team to concentrate on more important tasks, ultimately increasing your bottom line. Consider how an all-in-one solution can transform your enterprise today!

Automate Your Company with Free Billing Software with GST Adherence

Managing statements can be a considerable drain on resources, especially for small businesses. Fortunately, numerous free billing software solutions now exist, and increasingly, these options offer built-in indirect tax compliance features. This allows you to easily calculate levies, generate correct reports, and file your filings with the regulatory bodies. Identifying the right system – one that smoothly Best billing software for retail shop integrates with your current workflow – is key to improving efficiency and minimizing the risk of expensive errors. Several providers offer intuitive interfaces and helpful support, making GST handling far less daunting.

Selecting a GST Billing Solution for New Company Managers

Navigating the complex tax regime can be an challenge for small companies. Fortunately, several excellent GST payment platforms are specifically built to streamline the process. Explore options like Tally, known for their user-friendly interface and comprehensive capabilities. Alternatively, platforms such as Karvy offer niche features tailored for tax. Before choosing a option, consider elements like cost, convenience of implementation, and help available. Ultimately, the best solution is one suitably fits the unique needs.

Streamlined Payment and Inventory Control Software

Running a business can be difficult, especially when it comes to processing finances and keeping inventory. Thankfully, new intuitive billing and inventory control software solutions are accessible to help minor firms prosper. These systems often offer self-acting billing creation, current product updates, and robust reporting, allowing you to concentrate your time on growing your brand instead of being overwhelmed in tedious administrative tasks. Explore adopting such a platform to boost efficiency and reduce mistakes.

Free & Easy GST Invoice Maker

Navigating the complexities of Indian business often demands robust solutions for product and payment processes. Numerous small and medium-sized enterprises (SMEs) in India struggle with disparate spreadsheets and manual methods, leading to mistakes, lost income, and wasted effort. A updated system can drastically improve efficiency by automating tasks and providing real-time insight into your inventory levels and billing cycles. Evaluate cloud-based software designed specifically for the Indian market—these often include features like GST compliance, multiple currency support, and customized reporting. Ultimately, efficient stock control and payment processes are crucial for profitability in today’s competitive Indian economy landscape.

Tax Ready Billing Solution for Small Enterprises

Navigating the demands of the Goods and Services Tax (GST) can be particularly challenging for minor businesses. That's why a reliable billing solution that's specifically for GST readiness is vital. Several companies now offer simple options that streamline indirect tax processes, from invoice generation to tax return submission. This guarantees accuracy and minimizes the risk of fines, allowing businesses to focus their time on development and core operations. Consider features like instant statement creation, tax computation, and easy documentation to identify the optimal solution for your demands.

Complimentary Obtain: GST Invoice Application within Your Company

Managing the GST reporting can be an considerable challenge for many small businesses. Fortunately, there’s a great answer available: free GST billing software. Such software helps simplify the payment workflow, ensure correct documentation, and lessen a chance of errors. Obtain them currently and discover a benefits of efficient tax handling. It's certain be impressed!

Streamlined Payment Software with Goods and Services Tax Support

Managing your company finances just got simpler with our intuitive invoicing software. This robust solution is specifically designed for growing businesses like yours, offering comprehensive Sales Tax compliance. Forget the headaches of manual record-keeping! Our software efficiently calculates GST, generates professional bills, and provides detailed analytics to assist you remain on top of your monetary obligations. Plus, its minimalist interface makes it easy to master, even if you’re not a business expert. Try the difference today!

Inventory Administration & Invoicing Platform: The Nation-Specific

The growing demands of the Indian market necessitate robust and adaptable inventory management and payment platform solutions. Unlike generic offerings, India-specific solutions consider unique challenges such as GST conformity, localized tax structures, and varying levels of digital understanding among business owners. Many providers are now focusing on features like multi-lingual support (Tamil and others), integration with local payment gateways (like UPI), and simplified reporting designed for easy reconciliation with government websites. These solutions also frequently incorporate functionality tailored for specific industries prevalent in India, such as retail, manufacturing, and wholesale. The ability to efficiently track goods, manage accounts, and automate billing processes has become crucial for both small-scale and large enterprises seeking to optimize operations and maintain a competitive position in the dynamic Indian commercial setting.

Streamline Your Payment with Goods & Services Tax – Complimentary Platforms Choices

Managing VAT compliance can be the real headache, especially for small businesses. Fortunately, plenty of budget-friendly applications available to automate your invoicing process. These programs can help you calculate sales tax accurately, generate compliant statements, and track your sales. Consider options like FreshBooks (with limited basic packages), or investigate open-source payment software tailored for sales tax filing. Always investigate the features and drawbacks before committing to a specific application.

Finest Free Invoice Software for Small Enterprises in India

Navigating the complexities of Sales Tax compliance can be a burden for businesses of all types. Fortunately, a growing number of no-cost Sales Tax billing software options are accessible, offering a notable alleviation to companies. These solutions often come packed with vital functions like automatic tax calculation, easy bill generation, protected information archiving, and sometimes even core analytics. Beyond simply reducing expenses, using no-cost GST payment software can improve efficiency, lessen blunders, and ultimately contribute to a stronger financial position. Several suppliers even offer advanced versions with extra functionality for a charge, providing a scalable answer as your business grows. In conclusion, adopting these programs is a wise action for any organization seeking to optimize their tax procedures.